Solutions

Grow your business

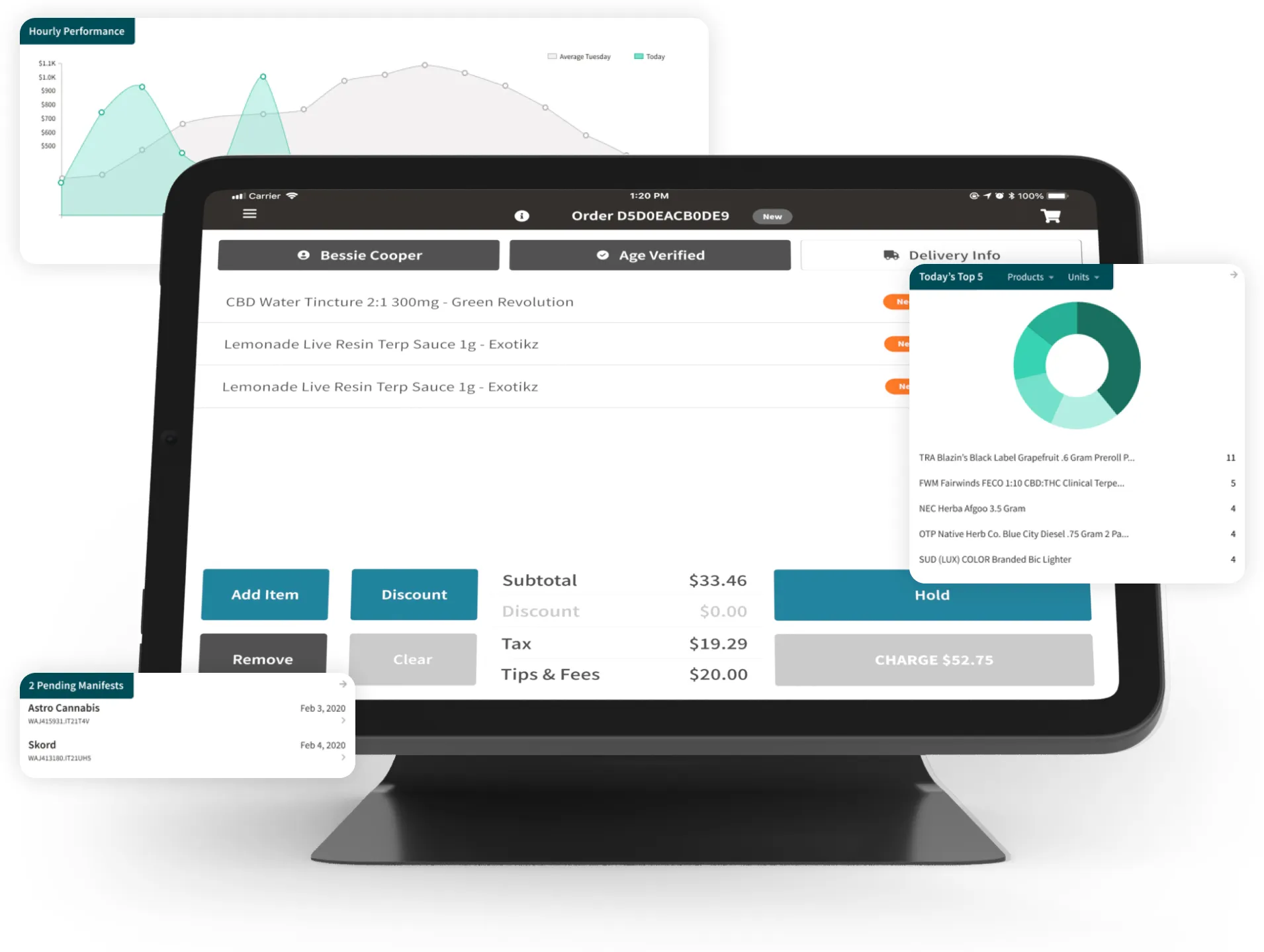

Simplify Operations

Grow your business

Discount Engine

->

Increase sales with customizable promotions

In-store Kiosk

->

Speed up checkouts with self service kiosks

Cultivation & Manufacturing

->

Streamline operations from seed to sale

Learn

Cannabis news, education, & advice on growing your business.

Data & Privacy

Government Relations

->

Fostering fair & sustainable cannabis policy

Data & Privacy

->

Security is built into the fabric of our operations